CPA for Real Estate Agents: Managing Cash Flow and Compliance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the intricacies of financial management for real estate agents, the importance of CPA services becomes increasingly evident.

Overview of CPA for Real Estate Agents

Real estate agents play a crucial role in facilitating property transactions, but managing finances and staying compliant with regulations are equally important aspects of their business. This is where Certified Public Accountants (CPAs) step in to provide valuable support.

CPAs specialize in financial management, tax planning, and regulatory compliance, making them essential partners for real estate agents. By leveraging their expertise, agents can streamline their cash flow, optimize tax strategies, and ensure adherence to financial regulations.

Financial Challenges Faced by Real Estate Agents

- Tracking Commission Payments: Real estate agents often receive commission payments at irregular intervals, making it challenging to maintain a stable cash flow. CPAs can help develop systems to track income and expenses, ensuring agents have a clear financial picture.

- Tax Compliance: Real estate transactions involve complex tax implications, requiring agents to navigate various deductions, credits, and reporting requirements. CPAs can provide guidance on tax planning strategies and ensure agents meet their tax obligations.

- Managing Overhead Costs: Running a real estate business involves overhead costs such as marketing expenses, office rent, and staff salaries. CPAs can help agents analyze their expenses, identify cost-saving opportunities, and create budgets to improve profitability.

Importance of Cash Flow Management

Effective cash flow management is crucial for real estate agents to maintain financial stability and ensure the smooth operation of their business. It involves monitoring the inflow and outflow of funds to meet financial obligations, such as paying bills, salaries, and other expenses, while also planning for future investments and growth.

Comparison of Cash Flow Management Strategies

There are several cash flow management strategies that CPAs can implement for real estate agents:

- Implementing a budgeting and forecasting system to track income and expenses accurately.

- Setting aside funds for unforeseen expenses or market fluctuations to ensure financial stability.

- Negotiating favorable payment terms with vendors and suppliers to manage cash outflows effectively.

- Diversifying income sources to reduce reliance on a single revenue stream and improve cash flow.

Real-life Impact of Proper Cash Flow Management

Proper cash flow management can positively impact a real estate agent's business in various ways. For example, by maintaining a healthy cash flow, agents can seize opportunities for property acquisitions, invest in marketing initiatives to attract more clients, and weather economic downturns without facing financial strain.

In contrast, poor cash flow management can lead to missed business opportunities, accumulation of debt, and ultimately, the failure of the business.

Compliance Requirements for Real Estate Agents

Real estate agents are subject to various compliance regulations to ensure ethical conduct and transparency in their business practices. Failure to adhere to these regulations can have serious consequences, both legally and professionally. Certified Public Accountants (CPAs) play a crucial role in assisting real estate agents in meeting compliance standards and avoiding potential pitfalls.

Key Compliance Regulations

- Anti-Money Laundering (AML) Regulations: Real estate agents are required to verify the identity of their clients and report any suspicious transactions to combat money laundering activities.

- Real Estate Settlement Procedures Act (RESPA): This regulation aims to protect consumers by requiring disclosure of all closing costs and prohibiting kickbacks or referral fees.

- Fair Housing Act: Agents must adhere to fair housing practices and ensure equal opportunity in housing transactions without discrimination based on race, color, religion, sex, disability, familial status, or national origin.

Consequences of Non-Compliance

- Legal Penalties: Violating compliance regulations can result in fines, lawsuits, or even license revocation, damaging the reputation and credibility of the real estate agent.

- Loss of Trust: Non-compliance erodes trust with clients, leading to lost business opportunities and tarnished relationships within the industry.

- Reputational Damage: Public scrutiny and negative publicity can significantly impact an agent's career and future prospects in the real estate market.

Role of CPAs in Ensuring Compliance

- CPAs assist real estate agents in implementing internal controls and processes to ensure compliance with regulations, conducting regular audits to identify and address any potential issues.

- They provide guidance on record-keeping requirements, financial reporting standards, and tax obligations to maintain transparency and accountability in the business operations.

- CPAs help real estate agents navigate complex compliance frameworks, staying updated on regulatory changes and industry best practices to mitigate risks and ensure regulatory compliance.

Tax Planning and Preparation

Tax planning and preparation are crucial aspects of a CPA's role in assisting real estate agents in managing their finances efficiently and maximizing tax savings. By understanding the complex tax laws and regulations specific to the real estate industry, CPAs can provide valuable insights and strategies to minimize tax liabilities and ensure compliance.

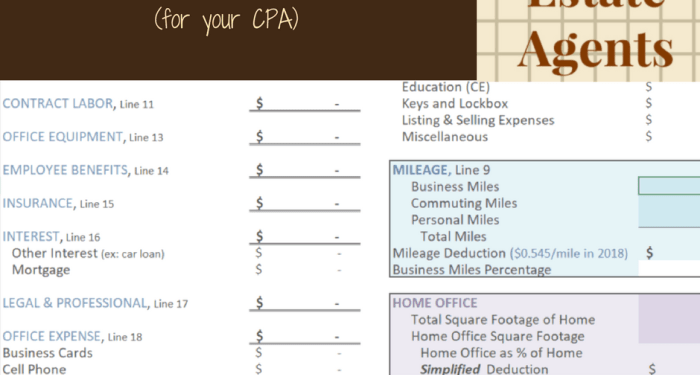

Common Tax Deductions for Real Estate Agents

- Home office expenses

- Vehicle expenses for business use

- Marketing and advertising costs

- Professional development and education expenses

- Insurance premiums

- Interest on business loans

Optimizing Tax Deductions

- Keep detailed records of all expenses to substantiate deductions during tax preparation.

- Maximize retirement contributions to reduce taxable income.

- Utilize tax credits and incentives specific to the real estate industry.

- Coordinate with a CPA to identify and claim all eligible deductions and credits.

Year-Round Tax Planning Strategies

- Regularly review financial statements and projections to anticipate tax implications.

- Adjust estimated tax payments to avoid underpayment penalties.

- Stay informed about changes in tax laws and regulations affecting real estate agents.

- Collaborate with a CPA to develop a customized tax planning strategy for long-term financial success.

Summary

In conclusion, CPA for Real Estate Agents: Managing Cash Flow and Compliance illuminates the crucial role CPAs play in ensuring financial stability and regulatory adherence within the real estate industry.

Essential FAQs

What are some common financial challenges real estate agents face?

Real estate agents often struggle with fluctuating income, managing overhead costs, and navigating complex tax regulations. CPAs can provide tailored solutions to address these challenges.

How can CPAs help real estate agents with tax planning?

CPAs assist real estate agents in maximizing tax deductions, optimizing tax strategies, and ensuring compliance with tax laws to minimize liabilities and enhance financial performance.