Exploring the realm of multi-family office services and their crucial role in supporting global real estate holdings unveils a world of tailored financial solutions and strategic management. As high-net-worth individuals seek to optimize their real estate portfolios on a global scale, multi-family offices stand out as key players in providing personalized and comprehensive services.

Let's delve into the intricate landscape of how these specialized services drive success in the realm of global real estate investments.

Definition of Multi Family Office Services

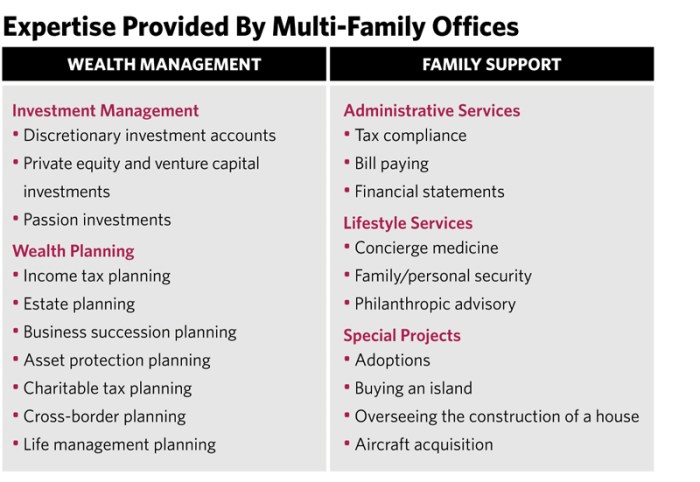

Multi-family office services are specialized wealth management services tailored to meet the needs of high-net-worth individuals and families. These services go beyond traditional financial planning and investment management, providing comprehensive support in areas such as estate planning, tax optimization, philanthropic strategies, and family governance.

Types of Services Offered by Multi-Family Offices

- Investment Management: Multi-family offices develop customized investment strategies based on the unique goals and risk tolerance of each client.

- Financial Planning: They offer comprehensive financial planning services, including retirement planning, cash flow analysis, and insurance planning.

- Estate Planning: Multi-family offices help clients develop strategies to preserve and transfer wealth to future generations while minimizing tax implications.

- Tax Optimization: They work with clients and their tax advisors to develop tax-efficient strategies for wealth preservation and growth.

- Philanthropic Services: Multi-family offices assist clients in establishing and managing charitable foundations, donor-advised funds, and other philanthropic vehicles.

Differences from Other Financial Service Providers

Multi-family offices differ from traditional wealth management firms and private banks in that they exclusively serve a limited number of ultra-high-net-worth clients. This allows them to provide highly personalized services and tailor their offerings to meet the specific needs and goals of each client.

Unlike traditional financial advisors, multi-family offices often take a holistic approach to wealth management, addressing not only investment needs but also broader financial, estate, and legacy planning considerations.

Importance of Multi Family Office Services for Global Real Estate Holdings

Family offices play a crucial role in managing the complex and diverse nature of global real estate holdings for high-net-worth individuals. These services provide tailored solutions to optimize and diversify real estate portfolios on a global scale, ensuring the efficient management of assets and wealth preservation.

Significance of Multi Family Office Services

- Multi-family offices offer specialized expertise in managing global real estate investments, taking into account various factors such as market trends, regulatory requirements, and risk management strategies.

- By leveraging their extensive network and knowledge of international real estate markets, family offices help clients identify lucrative investment opportunities and navigate the intricacies of cross-border transactions.

- These services assist in structuring real estate portfolios to minimize tax implications, enhance liquidity, and optimize returns, thereby maximizing the overall value of the investment.

Diversifying and Optimizing Real Estate Portfolios

- Family offices help high-net-worth individuals diversify their real estate holdings across different asset classes, geographies, and property types to reduce risk exposure and increase resilience to market fluctuations.

- Through thorough analysis and strategic planning, multi-family offices ensure that real estate investments align with the client's financial goals and risk tolerance, leading to a well-balanced and resilient portfolio.

- By continuously monitoring market trends and performance metrics, family offices can make timely adjustments to the real estate portfolio to capitalize on emerging opportunities and mitigate potential risks.

Customized Solutions for Global Real Estate Investments

- Multi-family offices work closely with high-net-worth individuals to understand their unique preferences, objectives, and constraints related to global real estate investments, offering personalized strategies that cater to their specific needs.

- These services provide access to a wide range of investment options, including direct property acquisitions, real estate funds, joint ventures, and co-investments, tailored to the client's investment horizon and return expectations.

- By offering comprehensive wealth management services in addition to real estate expertise, family offices ensure holistic financial planning and coordination to safeguard and grow the client's wealth over the long term.

Services Offered by Multi Family Offices to Support Global Real Estate Holdings

Multi family offices offer a range of specialized services to support clients with their global real estate investments. These services are tailored to meet the unique needs and challenges that come with managing real estate portfolios on an international scale.

Specific Services Tailored to Support Global Real Estate Investments

- Portfolio Diversification: Multi family offices help clients diversify their real estate holdings across different regions and property types to minimize risk and maximize returns.

- Market Research and Analysis: They provide in-depth market research and analysis to identify lucrative investment opportunities in global real estate markets.

- Asset Management: Multi family offices assist in managing and optimizing real estate assets to enhance their value and performance over time.

- Tax Planning and Structuring: They offer expertise in tax planning and structuring to help clients navigate complex global tax regulations and optimize their tax liabilities.

Assistance in Due Diligence Processes for International Real Estate Acquisitions

Multi family offices play a crucial role in assisting clients with due diligence processes for international real estate acquisitions. They conduct thorough assessments of potential properties, including legal, financial, and environmental due diligence, to ensure that clients make informed investment decisions and mitigate risks.

Role of Multi Family Offices in Risk Management and Compliance

Multi family offices help clients navigate the complexities of risk management and compliance related to global real estate investments. They implement robust risk management strategies to protect clients' investments and ensure compliance with regulatory requirements in different jurisdictions. Additionally, they monitor and assess risks associated with global real estate holdings to proactively mitigate potential threats to clients' portfolios.

Case Studies or Examples of Multi Family Office Support in Managing Global Real Estate Holdings

In the following section, we will delve into real-life examples and case studies that highlight how multi-family offices have successfully supported clients with their global real estate holdings.

Case Study 1: The Smith Family

The Smith Family, a wealthy family with diverse global real estate investments, sought the expertise of a multi-family office to streamline their portfolio management. The multi-family office conducted a thorough analysis of their properties across different regions and developed a comprehensive strategy to optimize returns while mitigating risks.

By leveraging their network and resources, the multi-family office successfully enhanced the Smith Family's global real estate portfolio performance.

Case Study 2: The Patel Group

The Patel Group, a multinational corporation with a significant real estate portfolio, faced challenges in managing their properties efficiently due to the complexity of regulations and market dynamics in various countries. A multi-family office was engaged to provide tailored solutions to navigate these complexities.

Through in-depth research and strategic planning, the multi-family office implemented innovative approaches to maximize the Patel Group's global real estate investments while ensuring compliance with local laws and regulations.

Comparative Analysis of Multi-Family Office Strategies

When comparing different approaches taken by multi-family offices in handling global real estate investments for clients, it becomes evident that each office customizes its services based on the unique needs and goals of the clients. Some offices focus on diversification across regions to minimize risk, while others concentrate on identifying emerging markets with high growth potential.

The key lies in the ability of multi-family offices to adapt to changing market conditions and provide tailored solutions that align with the clients' long-term objectives.

Last Word

In conclusion, the intricate web of services offered by multi-family offices proves instrumental in navigating the complexities of global real estate holdings. From tailored solutions to risk management strategies, these entities play a vital role in ensuring the success and growth of high-net-worth individuals' real estate investments on a global scale.

As the landscape of wealth management continues to evolve, the significance of multi-family office services in supporting global real estate holdings remains undeniable.

Key Questions Answered

How do multi-family offices differ from other financial service providers?

Multi-family offices offer personalized wealth management solutions tailored specifically to high-net-worth individuals and their families, focusing on a holistic approach to financial planning and investment management.

What specific services do multi-family offices provide to support global real estate holdings?

Services may include due diligence for international acquisitions, risk management strategies, compliance related to global real estate investments, and customized solutions for high-net-worth individuals.

Can you provide examples of successful case studies where multi-family offices supported clients with global real estate holdings?

Case studies showcase how these offices have effectively managed diverse real estate portfolios across regions, implementing strategies to optimize investments and navigate challenges successfully.