How Realtor CPAs Support Investment Property Portfolios sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

As we delve into the world of real estate investing, the role of Realtor CPAs becomes increasingly vital in ensuring successful management of investment property portfolios.

Overview of Realtor CPAs in Real Estate Investing

Realtor CPAs play a crucial role in supporting investment property portfolios by providing specialized financial and tax guidance to investors. Their expertise in real estate taxation and financial planning is essential for maximizing returns and minimizing tax liabilities in property investments.

Role of Realtor CPAs in Real Estate Investing

Realtor CPAs assist investors in managing tax implications related to real estate investments by:

- Advising on tax-efficient strategies for property acquisitions, ownership structures, and dispositions.

- Helping investors navigate complex tax laws and regulations specific to real estate transactions.

- Ensuring compliance with tax reporting requirements and optimizing deductions and credits available for real estate investments.

Importance of Having a Realtor CPA in Investment Team

Having a Realtor CPA as part of an investment team for property portfolios is crucial because:

- They can provide valuable insights into the financial implications of real estate investments, helping investors make informed decisions.

- Their expertise can help investors reduce tax burdens and maximize returns on investment properties.

- Realtor CPAs can assist in creating tax-efficient strategies that align with investors' long-term financial goals and objectives.

Tax Planning and Compliance

When it comes to investment properties, tax planning and compliance are crucial aspects that can significantly impact returns for real estate investors. Realtor CPAs play a vital role in helping investors navigate the complex tax regulations and maximize deductions within their investment property portfolios.

Specific Tax Planning Services

Realtor CPAs offer a range of tax planning services tailored to the unique needs of real estate investors. These services may include:

- Structuring ownership entities to optimize tax efficiency

- Advising on 1031 exchanges for tax-deferred property swaps

- Implementing strategies to maximize depreciation deductions

- Assisting with tax implications of property sales and acquisitions

Tax Compliance Strategies

Realtor CPAs implement various tax compliance strategies to ensure investors stay compliant with tax regulations while optimizing their investment returns. Some examples include:

- Monitoring changes in tax laws and regulations to proactively adjust strategies

- Preparing and filing accurate tax returns for investment properties

- Utilizing tax credits and incentives to minimize tax liabilities

- Auditing financial records to identify potential tax-saving opportunities

Maximizing Deductions

One of the key roles of Realtor CPAs is to help investors maximize deductions within their investment property portfolios. This may involve:

- Identifying all eligible deductions, such as mortgage interest, property taxes, and maintenance expenses

- Advising on ways to allocate expenses to different properties for optimal tax benefits

- Ensuring compliance with IRS regulations to avoid penalties and audits

- Providing guidance on record-keeping practices to support deduction claims

Financial Analysis and Reporting

Real estate investment portfolios require meticulous financial analysis and reporting to assess performance and make informed decisions. Realtor CPAs play a crucial role in analyzing financial data and providing valuable insights to property investors.

Methods of Financial Analysis

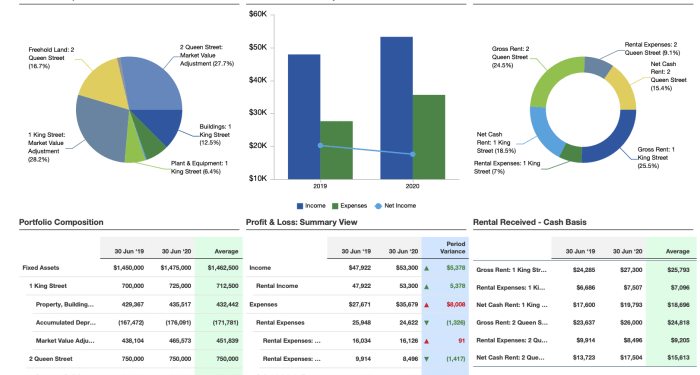

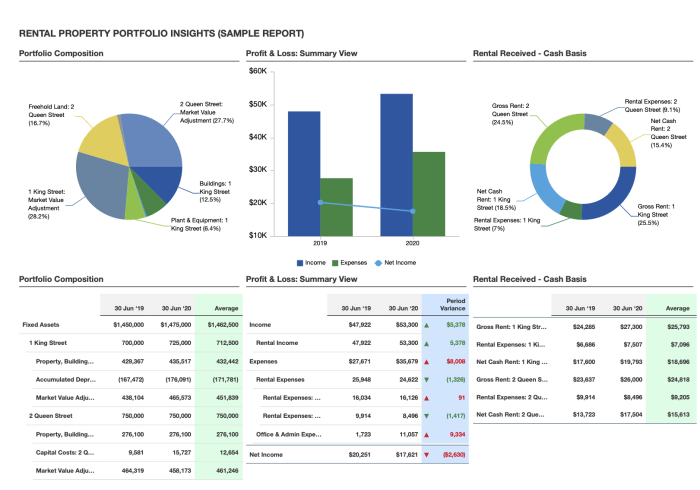

- Realtor CPAs utilize financial ratios to assess the profitability and efficiency of investment properties. These ratios may include metrics such as return on investment (ROI), cash-on-cash return, and net operating income (NOI).

- They conduct variance analysis to compare actual financial results with budgeted or forecasted figures. This helps identify areas of improvement or potential financial risks.

- Realtor CPAs also perform trend analysis to track financial performance over time and identify patterns or anomalies that may impact investment decisions.

Importance of Financial Reporting

Financial reporting is essential for decision-making in real estate investments as it provides a clear picture of the financial health of investment properties. It helps investors understand the current performance, identify areas of concern, and make strategic decisions to optimize returns.

Tracking and Reporting Financial Metrics

- Realtor CPAs use accounting software and tools to track and report financial metrics such as rental income, expenses, occupancy rates, and overall cash flow.

- They prepare detailed financial statements, including income statements, balance sheets, and cash flow statements, to provide a comprehensive overview of the investment property portfolio.

- Regular financial reporting allows investors to monitor the performance of their properties, make adjustments as needed, and plan for future investments or divestments based on accurate financial data.

Risk Management and Asset Protection

Investing in real estate comes with its own set of risks, which can impact the financial health of an investment property portfolio. Realtor CPAs play a crucial role in assessing and mitigating these risks to safeguard assets and minimize financial vulnerabilities for investors.

Risk Assessment and Mitigation Strategies

- Conducting thorough financial analysis to identify potential risks, such as market fluctuations, vacancy rates, or unexpected expenses.

- Developing risk management plans tailored to the specific needs and goals of the investment property portfolio.

- Implementing insurance coverage to protect against unforeseen events, such as property damage or liability claims.

- Utilizing diversification strategies to spread risk across different types of properties or locations.

End of Discussion

In conclusion, the support provided by Realtor CPAs in managing investment property portfolios is indispensable for investors looking to navigate the complex world of real estate investments with confidence and expertise.

FAQ Overview

How can Realtor CPAs help with tax implications related to real estate investments?

Realtor CPAs assist investors in understanding tax regulations, maximizing deductions, and optimizing tax compliance strategies for better investment returns.

What financial analysis methods do Realtor CPAs use for investment property portfolios?

Realtor CPAs utilize financial data analysis to provide insights into property performance, track financial metrics, and offer valuable information for decision-making in real estate investments.

How do Realtor CPAs protect investment properties from risks?

Realtor CPAs assess and mitigate risks associated with investment portfolios, safeguard assets, and implement strategies to minimize financial vulnerabilities for investors.